What Does Liquidity Refer to in a Life Insurance Policy

Assets include your properties like houses cars and jewelry. Some life insurance policies offer cash values that can be borrowed at any time and used for immediate needs.

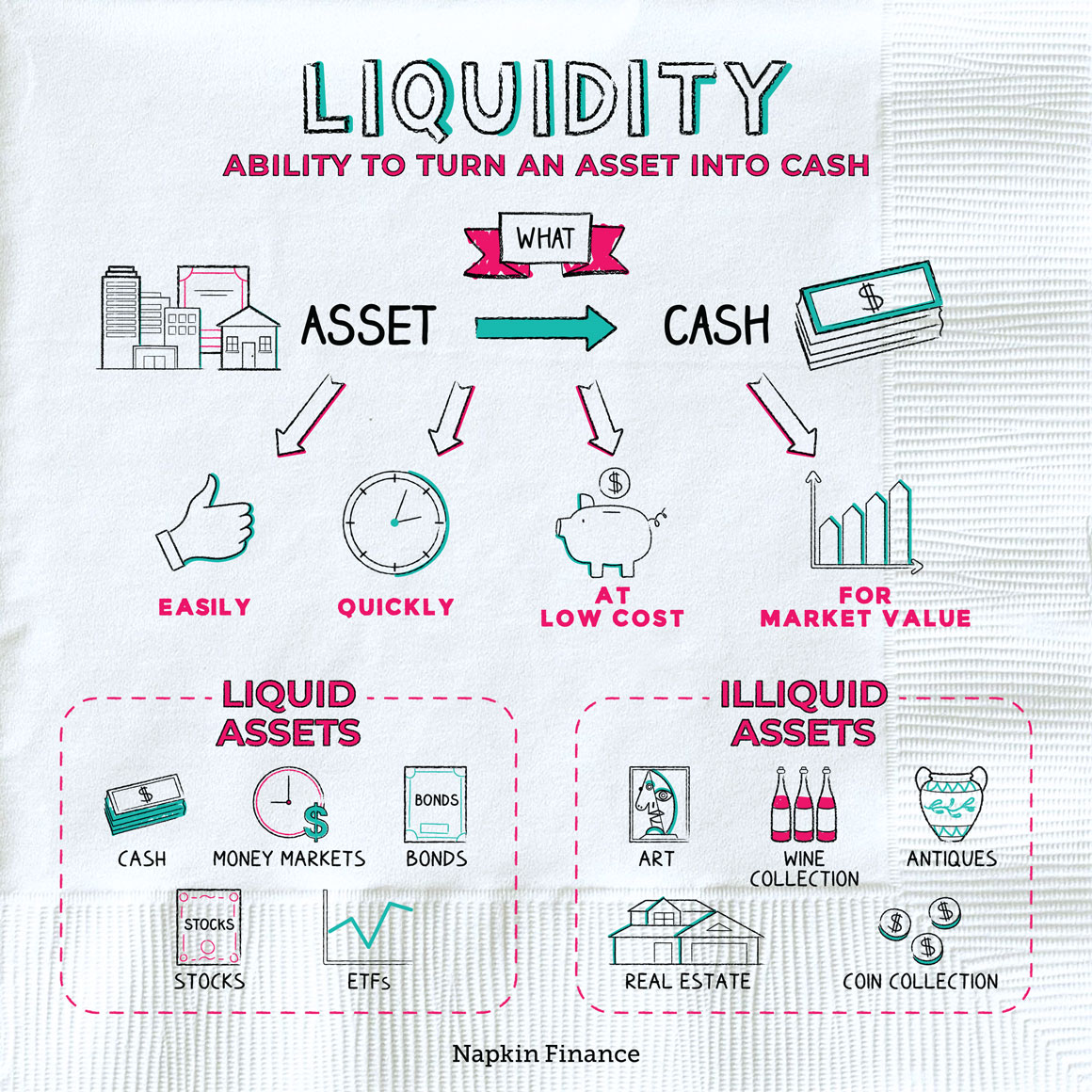

What Is Liquidity Liquidity Meaning Liquidity Definition

Insurance policies with high liquidity give you.

. Term life insurance doesnt have that cash-value component. The death benefit replaces the assets that would have accumulated in the insured had not died D. What does liquidity refer to in a life insurance policy.

With respect to life insurance liquidity refers to how easily you can access cash from the policy. This means that you can access the money in your policy whenever you need it without having to sell your home or other assets. The insured is receiving payments each month.

This can be very helpful in times of financial crisis. If you liquidate your life insurance policy the insurance company will give you the cash surrender value of the policy. The policyowner receives dividend checks each year.

The policyowner receives dividend checks each year. Expert answered yumdrea Points 60498. Heres what you should know about how that.

Liquidity in life insurance policies relates to how quickly and easily someone can convert a policy into cash either during the insured persons life or after theyve passed. The notion of liquidity applies to insurance policies that have a cash component such as permanent life insurance. Having liquidity essentially means that you can withdraw money from your policy or surrender the policy to access cash.

Liquidity or liquidation in a life insurance policy refers to how easily you can convert assets into money. One of the key benefits of having a life insurance policy is that it gives you liquidity. With this type of insurance a portion of your monthly payment is set aside and either put into a cash account or invested.

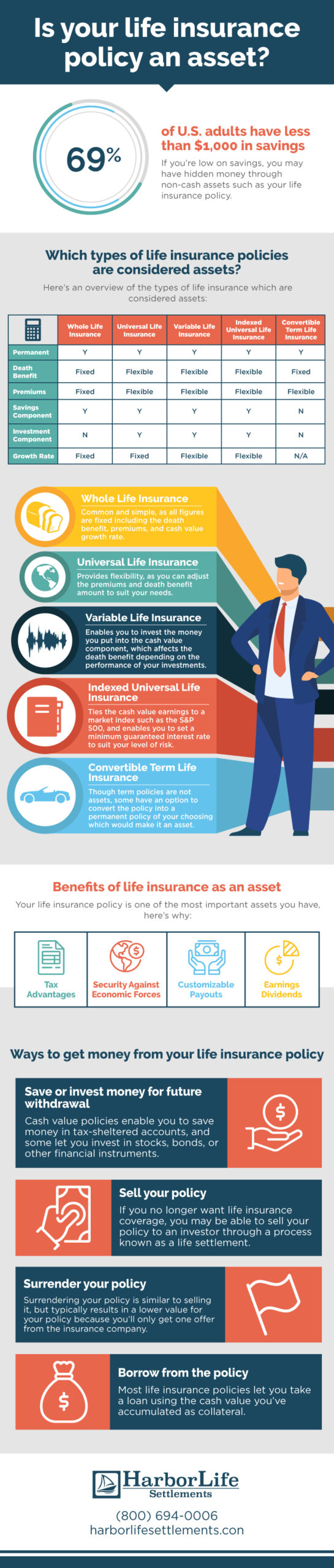

What does liquidity refer to in a life insurance policy. Now this feature if liquidity is not available in your term life insurance but you can get this feature in. Not all life insurance policies have liquidity and it will depend on the type of life insurance policy if it will have liquidity.

Practicetest2 Flashcards By Gabriel Martinez. It can apply to the accessibility of funds for both policyholders and beneficiaries. WINDOWPANE is the live-streaming social network and multi-media app for recording and sharing your amazing life.

A life insurance policys liquidity refers to how easy it is for someone to draw funds from a policy. Liquidity in a life insurance policy is a measure of the ease by which you can get cash from your policy while you are alive. Unfortunately Term life insurance policies dont provide liquidity and cannot be used to build cash value or pay for financial ventures during your lifetime.

Apr 14 2020 Liquidity in life insurance refers to availability of cash to the insured through cash values. Liquidity refers to how readily available the cash value of an insurance policy is. When most people only need simple cash coverage in terms and policies liquidity in life insurance can boost either an emergency or a retirement fund with people that have a more complex need.

The owner can partially withdraw or borrow cash values while continuing the policy or the owner can. In the context of insurance liquidity refers to how easy it is for a policyholder to access cash from their life insurance policy. However some policies allow you to convert to the Whole life policy making Term life policies liquid.

So lets recap on our initial question What does liquidity refer to in a life insurance policy Liquidity refers to converting an asset into cash quickly and easily. A term life insurance policy does not have liquidity. Share thoughts events experiences and milestones as you travel along the path that is uniquely yours.

In the first few years the policy may have no value if canceled but over time the cash surrender value can grow. Liquidity in life insurance refers to availability of cash to the insured. Liquidity in life insurance is generally the cash surrender value of the policy.

What does liquidity refer to in a life insurance policy. Liquidity refers to how easily you can access cash from the policy. What does liquidity refer to in a life insurance policy A The policyowner receives dividend checks each year B The insured is receiving payments each month is retirement C Cash values can be borrowed at any time D The death benefit replaces the assets that would have accumulated if the insured not died.

What does liquidity refer to in a life insurance policy. Life insurance policies with a cash value component like whole life insurance have liquidity because you can easily withdraw from them or surrender the policies for money. Liquidity in life insurance generally refers to the cash value in permanent life insurance.

Cash values can be borrowed at any time C. Term life insurance policies do not have this feature and are therefore not deemed to be liquid. In a life insurance policy liquidity refers to the ability to build cash value and have immediate access to that cash value as loans from the life insurance policy.

This is important to consider when looking at life insurance as an asset because it can be. The concept applies mostly to permanent life insurance because it accumulates cash value over time. Post comments photos and videos or broadcast a live stream to friends family followers or everyone.

While the primary reason to have life insurance is the income tax free death benefit the living benefits of ownership derive from its cash value. The policy does not go into effect until the premium has been collected. Liquidity in life insurance refers to how easily you can get cash from your life insurance policy.

The liquidity of a life insurance policy refers to the availability of cash value to the policyholder. The insured receives payments each month in retirement B. The concept of liquidity in a life insurance policy essentially applies to permanent life insurance as this type of policy can accumulate cash value over time.

Therefore your policy must have a cash value.

No comments for "What Does Liquidity Refer to in a Life Insurance Policy"

Post a Comment